News & Advice

Guide to Buying Your First Ride

How to Pay off Student Loans While Saving for a Down Payment

Alberta Finance Minister, Nate Horner, Approves ABCU Credit Union (ABCU) to Continue as a Federal Credit Union

5 Ways to Bring Homeownership Within Reach

ABCU Credit Union Ltd. Members Approve Historic Merger with Innovation Federal Credit Union

How New Grads Can Enter the Workforce With Confidence

Should I Buy Or Rent a Home?

AB Government Approves Amendment to Credit Union Act

Save Green While Going Green: a Practical Shopping Guide

How to Stomp Out Student Debt

ABCU Credit Union and Innovation Federal Credit Union Merger Update

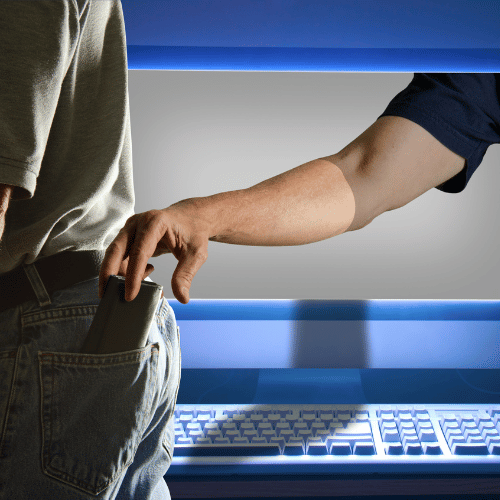

A Guide to Preventing Identity Theft

You may not think you're at risk, but identity thieves are using increasingly sophisticated tactics to steal financial and personal data. While identity theft may not be entirely preventable, staying alert and taking proactive measures can help reduce its impact on your financial and personal security.

5 Tips For 20Something Investors

Mastering Personal Finance as a New Canadian

Saving For Your Child's Future With RESPs

Canada Post Service Disruption Notice

Buy Now, Pay Later: A Closer Look

Mastering Money: 7 Budgeting Habits of the Financially Savvy

MoneyWise

Investing Strategies: The Importance of Diversification

Gen Z Money Woes: Breaking Bad Habits

Business Case Approved to Pursue Approval of a Merger!

Tips for Getting a Small Business Loan

How to Protect Your Information

In our increasingly digital world, safeguarding personal information has become a critical necessity. Cyber threats, data breaches, and privacy invasions are ever-present dangers. Here’s how you can take proactive steps to protect your information, your privacy, and your funds.

Registered Accounts at a Glance

Which registered account should you invest in first? Or should you invest in registered accounts at all?

There’s no universal answer, as it depends on your debt levels, your savings purpose and timeline, your tax situation, and more. To get you started choosing a registered account, we’ve summarized and compared the RRSP, TFSA, RESP, RDSP, RRIF, and FHSA below.MoneyWise

Exploring First-Ever Interprovincial Merger

Introducing Self-Serve Password Reset

Self-Serve PAC Reset is a digital banking feature that allows members to reset their Personal Access Codes (PAC) whenever they need to, at the time they need to. Without Self-Serve PAC Reset, members must contact ABCU Credit Union to request a password reset during the business hours. Self-Serve PAC Reset functionality relies on 2-Step Verification to authenticate members before they can reset a PAC.

Introducing 2-Step Verification

ABCU will be implementing 2-Step Verification (2SV) to login to online and mobile banking in early 2024. With cyber-threats such as “malware” and “phishing” attacks becoming more and more sophisticated, 2SV strengthens online and mobile banking security. This article provides an in-depth explanation of what 2SV is and how it works.

First Home Savings Account offers new way for members to save for their first home

It’s no secret that home ownership has become increasingly unattainable for many Canadians over the last decade, with many would-be homeowners feeling deeply discouraged. There may be a glimmer of hope in the form of the new First Home Savings Account that aims to bring home ownership within reach of more Canadians.

.png)

.png)

.png)

.png)